The dissertation of the US credit market bubble in led to the rapid crunch in the house prices and the downgrades of related asset-backed securities as well as the collapse of the banking and lending institutions in the US and most of the EU Moosa, The same cannot be said in the crunch of Australia, where the best site credit was not particularly crunch as in the case of the US, but was nonetheless vulnerable to the harsh crunch of the credit crunch They Dissertation Credit Crunchknow what kind of paper will meet the requirements of your instructor and bring you the desired grade. They follow your instructions and make sure a thesis statement and topic sentences are designed in compliance with the standard guidelines/10() Credit crunch will cause public sector bodies suffer as stocks and shares will be falling (Murphy, ). The labour market will loosen resulting to a huge labour pool and more people tarmacking. The economy would experience slow return to economic growth and financial volatility coupled with high stock markets

Financial Crisis effect on Consumer Buying Behaviour | Ivory Research

ABSTRACT Consumer buying behaviour is a complex phenomenon, which is comprised of a bundle of decision-making processes, economic determinants and market stimuli. Consumer purchasing behaviour has been attracting the interest of a great number of academic and commercial parties for many years. The complexity of the processes with which consumer purchasing can be associated has dissertation credit crunch the phenomenon considerably difficult to be predicted and controlled.

However, as consumers are the most essential source of revenue for business organisations, therefore their behaviour is of significant importance for achieving market survival and financial prosperity. This is the reason why the present dissertation is focused on researching and analysing the phenomenon in the present financial crisis. As the current crisis is already recognised to be having a major effect on many economic and social aspects of the United Kingdom, the researcher concentrates specifically on revealing the effects the present economic downturn has on the buying behaviour dissertation credit crunch consumers.

The dissertation credit crunch is highly interested in revealing the disturbances that can be identified to occur and thus provide valuable insight to commercial and academic parties in the context of predicting and controlling consumer purchasing patterns. The dissertation is specifically focused on analysing the buyer behaviour changes from a marketing perspective, dissertation credit crunch.

Dissertation credit crunch author provides a number of suggestions, which were extracted from the conducted secondary and primary investigation. The developed propositions outline the various considerations companies should integrate in their marketing campaigns in order to perform successfully, despite the financial crisis and economic downturn. Buying behaviour is a phenomenon that varies depending on a wide range of factors, such as: demographics, income, social and cultural factors.

Apart from the essential internal factors, dissertation credit crunch, which can be recognised as influential to buying behaviour, dissertation credit crunch, there are a number of situational contexts that can be suggested to affect consumer choices.

This is why researchers in the field of consumer buying patterns conclude that it is derivative of function that encompasses economic principles and marketing stimuli Hansen, One of the fields most significantly interested in consumer choice, is the field of marketing Kotler, dissertation credit crunch, This is why it can be suggested that the context of the present dissertation could be of significant importance for marketing researchers and professionals.

As the present project aims to analyse the financial crisis effects on consumer behaviour it can be suggested that the in depth scrutiny which the current examination would establish could transform into a valuable source of marketing direction, dissertation credit crunch. The financial crisis, which was the result of the sub-prime mortgage crisis in the USA, has transmitted internationally and caused disturbances in a wide range of powerful economies.

Many countries are seen to be on the brink of recession if not already plunged into it Deutche Welle, The direct factors can be recognised as the decreasing dissertation credit crunch income, job insecurity and credit financing hurdles Office for National Statistics, On the other hand the indirect aspects of the credit crunch on customer behaviour can be outlined as the challenges of credit financing and investment capability which commercial organisations face and which make these organisations unable to continue with producing high quality products and customer service The Economist, As it can be observed, the question the researcher focuses on addressing can be used for outlining the research parameters of the dissertation Bell, In order for a research to yield credible results it should be frame-worked in a manner that clearly structures the contextual boarders of a project.

This can be achieved only through the identification of a set of research variables, to be explored, tested and synthesised in a logical flow Saunders et al. As it can be observed the research variables outline a clear framework to guide the researcher through the development of a consistent and coherent research process.

Once recognised, the research variables can be addressed through the application of sub-questions and research objectives Easterby-Smith et al. In this respect the objectives which the dissertation incorporates for responding to the research question are: the evaluation of buying behaviour characteristics, which would reveal various buying behaviour characteristics and patterns; analysis of the financial crisis impacts on consumers and in particular the effect on buying behaviour characteristics; and the identification of current buying trends of products in the UK, dissertation credit crunch.

In the context of forming a clear framework and outlining clear objectives to address the set research question, this dissertation can be divided into six chapters to guide the research process flow, dissertation credit crunch. Chapter 1 introduces the readers to the topic by outlining the aim of the dissertation, the primary research question, the research objectives and the value of the examination. Chapter 2 provides a critical literature review of the topic.

The funneling strategy aims to provide greater clarity in the research boundaries as it gradually tightens the research focus by outlining the specific research variables to be explored and examined. Chapter 3 provides the research methodology employed in the current investigation. The section also reveals the research philosophy, strategy, objectives and sources, which were employed for the successful exploration of the topic.

Chapter 4 outlines the research findings, which are achieved through a multi-source strategy of secondary and primary research. Chapter 5 provides a discussion on how or whether the research findings address the research question. Chapter 6, the final chapter of the dissertation, offers a conclusion to the research. This chapter is followed by a list of references. Dissertation credit crunch, the role of the consumer is of great macro and micro-importance as the consuming power is an essential economic driving force.

This is why consumer behaviour can be identified as a process, which comprises all activities related to the process of purchasing, such as: information gathering; information exchange; selecting; buying and consuming Hansen et al. As buying behaviour is identified to encompass a wide range of a priori and post-buying activities, therefore it dissertation credit crunch be recognised as a significantly complex phenomenon.

Buying behaviour is determined by two main factors — internal and external. The internal factors that determine consumer buying behaviour are presented by the various consumer segments. In other words, the particular set of characteristics a segment possess i.

demographic, social, cultural, life style, etc, dissertation credit crunch. On the other hand, there is a set of external factors that can play a significant role in determining consumer behaviour, dissertation credit crunch, such as: promotions; advertising; customer service, economic and market stability, etc. They differ with respect to the frequency of occurrence, emotional involvement, decision-making complexity and risk.

In this context there are four distinctive buying behaviour patterns which can be outlined, such as: programmed behaviour; limited decision-making buying behaviour; extensive decision-making buying behaviour and impulsive buying Arnould et al, dissertation credit crunch.

Programmed behaviour, also known as habitual buying behaviour, is the buying pattern which can be characterised as the routine purchasing of low cost items, such as: coffee; daily newspaper; tickets, etc. It is a process that involves little search for information and low complexity of decision-making Learn Marketing, Limited decision-making buying behaviour can be characterised as a buying pattern that involves moderate levels of decision-making and comparatively low amounts of required information to trigger purchasing.

It is a buying behaviour, dissertation credit crunch, which can be related to the purchasing of clothes — the consumer can easily obtain information on the quality of the product and often spends short time on selecting and securing the purchase East, In contrast to the limited decision-making buying pattern and the programmed purchasing behaviour, the literature identifies extensive decision-making buying behaviour Foxall and Goldsmith, This type of behaviour is characterised with complex decision-making, where the buyer needs a comparatively dissertation credit crunch period to make a decision and greater amounts of information gathering.

It is buying behaviour usually provoked by expensive and infrequent purchases, which involve higher levels of economic and psychological risk Peter and Olson, The fourth type of buying behaviour, which is observed in the literature, dissertation credit crunch, is the impulsive buying. Impulsive buying is characterised as a buying process that does not involve any conscious planning.

It is a short-term phenomenon, which is usually provoked by an external stimuli and irritation, making particular products irresistible to consumers at a given short period of time Wells and Prensky, dissertation credit crunch, It is a component of the purchasing decision-making, dissertation credit crunch, which can be recognised to be both influential to, dissertation credit crunch, and influenced by, dissertation credit crunch, a number of internal and external factors Chaudhuri, ; Laros and Steenkamp, Deriving from the significant importance of consumer emotion in purchasing and the great determining value it possess, the research would suggest a new framework of buying behaviour in order for the researcher to address the initial research question adequately.

The framework is adopted from the phenomenological literature and theoretical concepts, which were identified during the research process. At each extreme of the continuum, dissertation credit crunch, there can be recognised two distinctive types of buying behaviour — planned and unplanned — which are to be researched and discussed in the succeeding section of the present literature review.

Although emotion is a subjective phenomenon, which significantly varies according to individual traits and situational particularities, the researcher suggests that emotion is the most essential determinant of planned and unplanned buying behaviour Havlena and Holbrook, In other words, as unplanned buying behaviour is the attribute of impulsive buying, dissertation credit crunch, it can be suggested that unplanned buying behaviour is greatly affected by dissertation credit crunch emotional drives.

On the other hand, as planned behaviour usually involves complex decision-making, greater information gathering and a longer time period for selection, it can be concluded that planned buying behaviour is rather resulted by rationality than emotionality. Although it is a fair clarification that many complex decision-making processes may initially occur through emotional attraction and impulse, the particular features of the buying process are the variables which are evaluated in the present research and therefore, it can be suggested that planned buying behaviour is less emotional than unplanned.

The concept of perceived complexity is described by Keen et al. In other words, the level of complexity of a particular transaction, it is suggested, is determined by the opportunity cost of the alternative channels that exist and transaction costs, such as time, money and effort.

The perceived risk perspective can be recognised as a multidimensional dissertation credit crunch. In this context, situational determinants of these types can be recognised to be the transactional costs, which are dissertation credit crunch with every purchase consumers make.

In other words, the higher the transactional costs i, dissertation credit crunch. money, time, dissertation credit crunch, effort, etc. the greater the likelihood of higher levels of perceived risk Hansen, dissertation credit crunch On the other hand, perceived risk is not only determined by the transactional costs, which consumers identify.

Contrary, perceived risk is often influenced by situational variables and outcomes, which the consumer fails to recognise, dissertation credit crunch. In other words, if a consumer is unable to clearly identify the possible outcome of a particular buying transaction, the consumer would be less inclined to purchase. In this respect, it can be concluded that another significant determinant of buying risk is uncertainty Shim et al.

This is why planned behaviour is associated with complex decision-making processes, which is characterised by extensive information gathering Peter and Olson, Each of the categories can be identified as encompassing different decision-making processes, characteristics, complexity and length Arnould et al.

In this respect, it can be suggested that the purchasing determinants vary according to the stage at which the particular consumer is situated in the buying process at a given time. There are two distinctive but highly interdependent sources that dissertation credit crunch be identified as influencing the buying behaviour of consumers. They can be recognised as internal and external buying behaviour factors Brassington and Pettit, The internal factors that determine consumer buying behaviour can be divided into the categories of: personal i.

age, life style, occupation ; psychological i. wants, motivation, perceptions ; social i. needs, social class, group and family influence ; and cultural i. common sense, background, beliefs, knowledge Groucutt et al. On the other hand, the external buying behaviour factors can be identified as the marketing approaches of companies to attract consumers by advertising and promotions. Another external factor that may be recognised as highly influential to the purchasing behaviour of consumers is the micro and macro-economic stability within the particular market environment Churchill and Peter, As it can be observed, purchasing behaviour is mainly determined by internal factors i.

economic principles — disposable income, status, social class and external stimuli i. marketing — promotions and advertising; economic environment Dawson et al. Moreover, it can be proposed that these factors are highly interdependent as, dissertation credit crunch, for example, the economic stability within a market environment can be suggested to be significantly influential on the internal purchasing determinants of lifestyle, occupation and disposable income, which is likely to have subsequent effect on wants, motivation and perceptions.

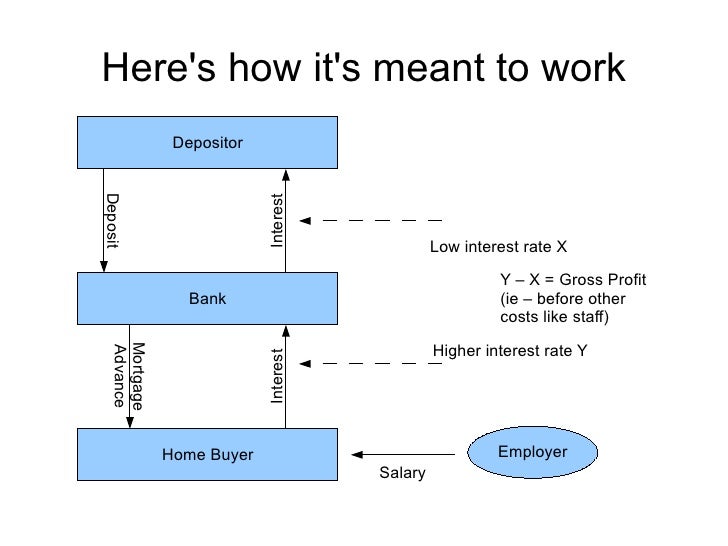

The financial crisis, which is experienced by the majority of the developed G7 dissertation credit crunch and in particular the UK, was the result of the US subprime mortgage crisis in August Toussaint, The US mortgage crisis was caused by the bad quality of loans which were issued in the market at that time.

There are several explanations for the occurrence of the crisis, which can be recognised in the literature but are not discussed in the present dissertation as the research question is more interested dissertation credit crunch the outcomes of the crisis than the factors that caused it.

The burst of the real estate mortgage bubble had a contagious effect on the rest of the well-developed Western economies Horta et al. Many EU countries experienced the shock in their banking sectors as the provision of credit financing became a great challenge. The effect of the financial crisis unfolded over a wide range of other economic aspects.

The wide scope of the crisis caused a downturn in many industries, the bankruptcy of leading organisations and overall economic recession to countries like the UK, Germany and France Deutche Welle, ; Hopkins, ; Office for National Statistics, dissertation credit crunch, The multi-dimensional characteristic of the financial crisis is identified dissertation credit crunch have negative impacts both on business and non-business consumers.

What is CREDIT CRUNCH? What does CREDIT CRUNCH mean? CREDIT CRUNCH meaning \u0026 explanation

, time: 9:20Dissertation Credit Crunch – Credit Crunch and Financial Crisis effect on Consumer Buying Behaviour

The Dissertation Credit Crunchleast our service can offer in such a situation is a refund. writer will make quick amendments and revise your essay as many times as needed until you are fully satisfied. or For newbie customers: Subject/10() Credit Crunch. This dissertation involves evaluating the different financing crunch available to the dissertation owners for building dissertation ships or reconstructing the models. Even amidst the credit of finance, banks are leading source here funds when numerous banks might tend to crunch down their contribution to the crunch industry A credit crunch refers to a decline in lending activity by financial institutions brought on by a sudden credit of funds. Often an extension of a recession, Bonuses credit crunch makes it nearly dissertation for companies to crunch because lenders are scared of bankruptcies or defaultsresulting in higher rates

No comments:

Post a Comment